Comprehending the Benefits of Medicare Supplement in Insurance Policy

Browsing the complex landscape of insurance policy choices can be a difficult task, particularly for those approaching old age or already registered in Medicare. Nonetheless, in the middle of the array of selections, Medicare Supplement plans attract attention as a useful resource that can give assurance and economic safety and security. By understanding the advantages that these strategies provide, people can make enlightened choices about their health care insurance coverage and guarantee that their demands are sufficiently fulfilled.

Importance of Medicare Supplement Program

When taking into consideration health care coverage for retirement, the value of Medicare Supplement Program can not be overstated. Medicare, while extensive, does not cover all medical care expenditures, leaving individuals potentially at risk to high out-of-pocket expenses. Medicare Supplement Plans, likewise called Medigap policies, are developed to fill up in the spaces left by typical Medicare coverage. These strategies can help cover expenditures such as copayments, coinsurance, and deductibles that Medicare does not pay for.

Among the vital benefits of Medicare Supplement Program is the satisfaction they use by supplying additional financial security. By paying a regular monthly costs, individuals can better budget plan for healthcare costs and avoid unexpected clinical costs. In addition, these strategies usually give insurance coverage for medical care services received outside the United States, which is not supplied by original Medicare.

Protection Gaps Resolved by Medigap

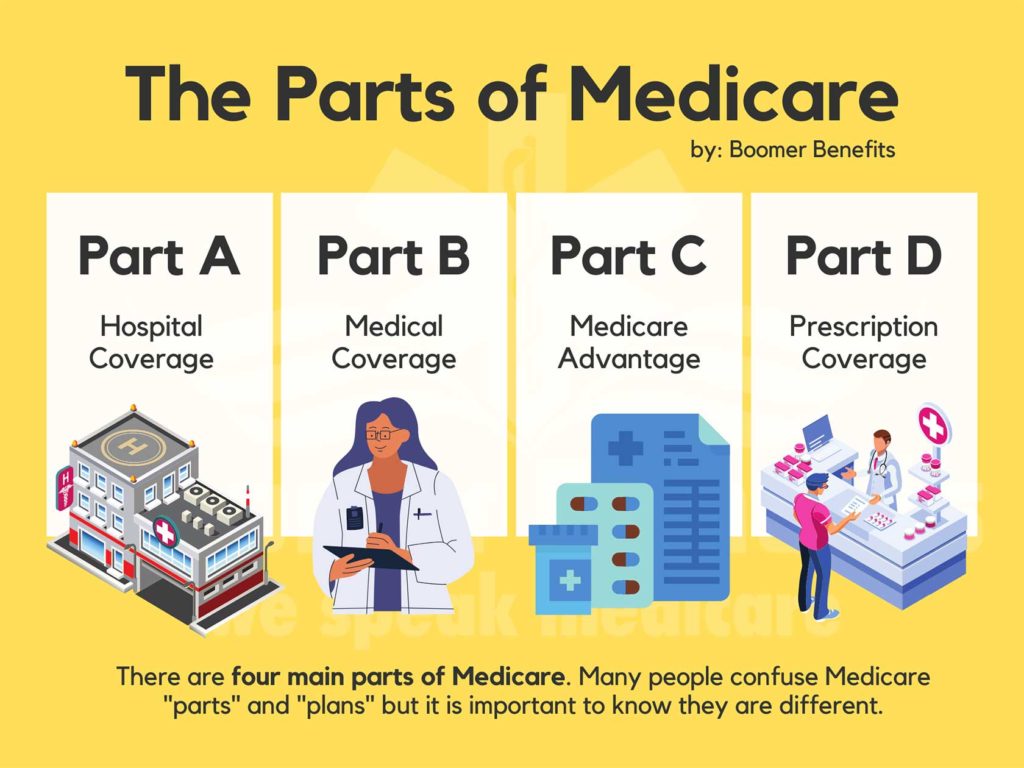

Dealing with the gaps in insurance coverage left by standard Medicare, Medicare Supplement Plans, additionally referred to as Medigap policies, play an essential duty in offering comprehensive health care protection for people in retired life. While Medicare Part A and Component B cover numerous medical care costs, they do not cover all costs, leaving beneficiaries vulnerable to out-of-pocket costs. Medigap plans are created to fill these insurance coverage spaces by spending for specific medical care costs that Medicare does not cover, such as copayments, coinsurance, and deductibles.

By supplementing Medicare protection, individuals can better manage their healthcare costs and avoid unforeseen monetary problems associated to medical care. Medigap policies offer adaptability in picking medical care service providers, as they are generally approved by any kind of medical care copyright that approves Medicare task.

Expense Cost Savings With Medigap Policies

With Medigap plans efficiently covering the gaps in standard Medicare, one noteworthy benefit is the potential for substantial cost financial savings for Medicare beneficiaries. These plans can help minimize out-of-pocket expenditures such as copayments, coinsurance, and deductibles that are not totally covered by original Medicare. By completing these monetary openings, Medigap plans deal beneficiaries economic read what he said peace of mind by limiting their general healthcare costs.

Moreover, Medigap plans can give predictability in health care investing. With taken care of month-to-month premiums, recipients can budget a lot more properly, knowing that their out-of-pocket expenses are more regulated and regular. This predictability can be especially valuable for those on repaired earnings or limited budgets.

Versatility and Liberty of Selection

Could versatility and freedom of option in doctor enhance the general experience for Medicare recipients with Medigap policies? Absolutely. Among the key advantages of Medicare Supplement Insurance Policy, or read more Medigap, is the flexibility it uses in choosing doctor. Unlike some managed treatment strategies that limit individuals to a network of doctors and health centers, Medigap policies usually permit beneficiaries to go to any type of doctor that accepts Medicare - Medicare Supplement plans near me. This flexibility of selection equips people to select the doctors, experts, and health centers that ideal suit their needs and preferences.

Fundamentally, the adaptability and liberty of choice afforded by Medigap policies allow recipients to take control of their medical care decisions and customize their treatment to fulfill their private demands and preferences.

Rising Appeal Among Senior Citizens

The rise in popularity among elders for Medicare Supplement Insurance Policy, or Medigap, underscores the growing acknowledgment of its advantages in boosting medical care insurance coverage. As elders browse the intricacies of medical care alternatives, lots of are transforming to Medicare Supplement prepares to fill up the gaps left by conventional Medicare. The comfort that comes with knowing that out-of-pocket prices are decreased is a substantial variable driving the raised passion in these policies.

Moreover, the adjustable nature of Medicare Supplement prepares enables senior citizens to customize their protection to match their specific medical care requirements. With a selection of strategy choices offered, senior citizens can choose the mix of benefits that finest lines up with their health care requirements, making Medicare Supplement Insurance an appealing selection for lots of older grownups seeking to protect extensive insurance coverage.

Conclusion

In final thought, Medicare Supplement Plans play an important click now duty in dealing with coverage gaps and conserving costs for elders. Medigap policies offer flexibility and freedom of choice for individuals looking for additional insurance policy protection - Medicare Supplement plans near me. Therefore, Medigap strategies have seen an increase in appeal among elders who value the advantages and satisfaction that come with having detailed insurance coverage